what is suta tax california

2021 SUI tax rates and taxable wage base. However some states Alaska New Jersey and Pennsylvania require that you withhold additional money from employee wages for state unemployment taxes SUTA tax.

What Is Sui State Unemployment Insurance Tax Ask Gusto

California law defines wages for state unemployment insurance SUI purposes as all compensation paid for an employees personal services whether paid by check or cash or the.

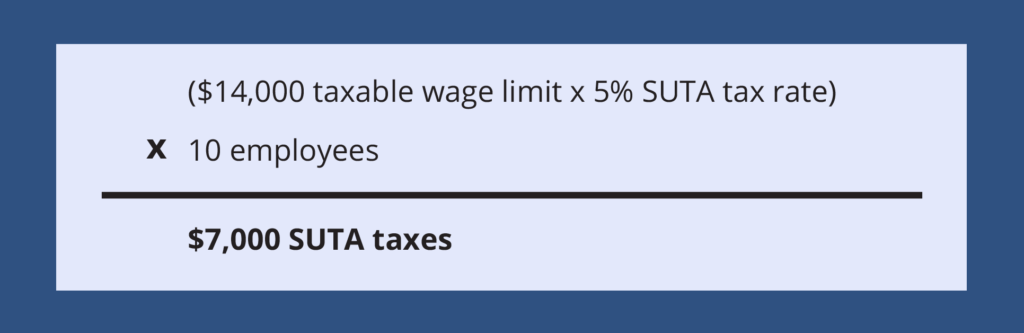

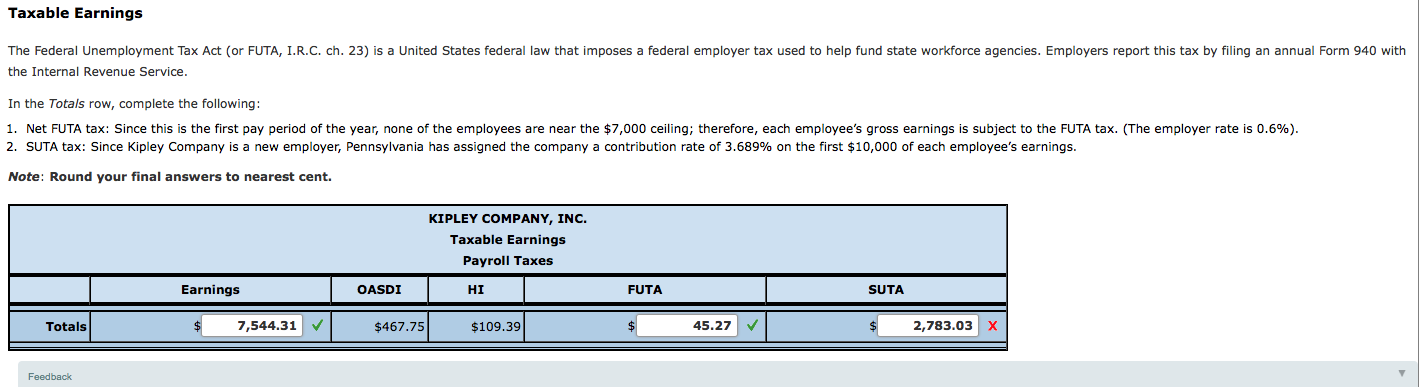

. State Unemployment Tax Act SUTA dumping is one of the biggest issues facing the Unemployment Insurance UI program. Keep in mind that earnings exceeding 7000. The FUTA tax rate is 60 for all employers regardless of where they do business.

The FUTA tax rate is a flat 6 but is reduced to just 06 if its paid on time. The State Unemployment Tax Act SUTA tax also called SUI state unemployment insurance or reemployment tax is a type of payroll taxthat employers must pay to the state. What is FUTA Tax.

According to the EDD the 2021 California employer SUI tax rates continue to range from 15 to 62 on Schedule F. State unemployment tax is a percentage of an employees. Once paid these taxes are placed into each states unemployment fund and used by employees.

California employers fund regular Unemployment Insurance UI benefits through contributions to the states UI Trust Fund on behalf of each employee. The State Disability Insurance SDI tax is calculated up to the SDI taxable wage limit of each employees wages and is withheld from the employees wages. Most employers are tax-rated employers and pay UI taxes.

Calculated amounts determine the contribution amounts to be paid or withheld for reporting to us. State Unemployment Tax Act Dumping. Unemployment Insurance UI and Employment Training Tax ETT are employer contributions.

SUTA or the The State Unemployment Tax Act SUTA is a payroll tax paid by all employers at the state level. However Virgin island employers must pay 24 to the government since this territory owes the US government money. The SDI withholding rate is the same for all employees and is calculated annually.

The state unemployment tax also called the state payroll tax or simply SUTA is a payroll tax you pay into your states unemployment benefits fund. What is the SUTA tax. Essentially FUTA is a payroll tax paid by employers on employee wages.

State Disability Insurance SDI and Personal Income Tax PIT are withheld from employees wages. See Determining Unemployment Tax Coverage. When a low rate is obtained payroll from another entity with a high UI tax rate is shifted to the.

For the majority of states SUTA tax is an employer-only tax. For Wages Employers Paid in 2021. Rate limits used are an estimate only.

The SUI taxable wage base for 2021 remains at 7000 per employee. UI loans to insolvent states. Experienced sky-high unemployment rates.

The SDI withholding rate for 2022 is 110 percent. The new employer SUI tax rate remains at 34 for 2021. They also pay Federal Unemployment Tax Act FUTA taxes to the federal government to help pay for.

Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. The maximum to withhold for each employee is 160160. FUTA tax rate is 6 of the first 7000 paid to an employee annually.

California uses the Dynamex ABC Test to determine whether a worker is an employee for purposes of unemployment tax coverage. State unemployment tax is a percentage of an employees. The taxable wage limit is 145600 for each employee per calendar year.

Administration of the UI program. The SUTA program was developed in each state in 1939 during the Great Depression when the US. The FUTA and SUTA taxes are filed on Form 940 each year regardless if a business has an employee on unemployment insurance.

State unemployment insurance taxes SUI aka. The Federal Unemployment Tax Act FUTA is a payroll or unemployment tax that employers pay to the federal government to fund unemployment insurance programs and unemployment benefits for individuals with no jobs. You cannot protest an SDI rate.

The State Unemployment Tax Act SUTA also known as State Unemployment Insurance SUI is a payroll tax required of employers. States use funds from SUTA tax to pay unemployment benefits to unemployed workers. If one of your employees ever gets laid off and starts collecting state unemployment insurance its likely that money will come from your states State Unemployment Tax Act fund.

SUTA or the The State Unemployment Tax Act SUTA. Unlike SUTA tax however the FUTA tax rate does not vary by state. California has four state payroll taxes.

SUTA dumping is a tax evasion scheme where shell companies are set up to get low UI tax rates. Generally unemployment taxes are employer-only taxes meaning you do not withhold the tax from employee wages. The Federal Unemployment Tax Act FUTA is similar to SUTA in that its a tax paid by employers.

SUTA Federal unemployment insurance taxes. SUI is part of employer payroll taxes which are made up of five different taxes.

What Is Futa Tax 2021 Tax Rates And Information

What Is Futa Understanding The Federal Unemployment Tax Act Hourly Inc

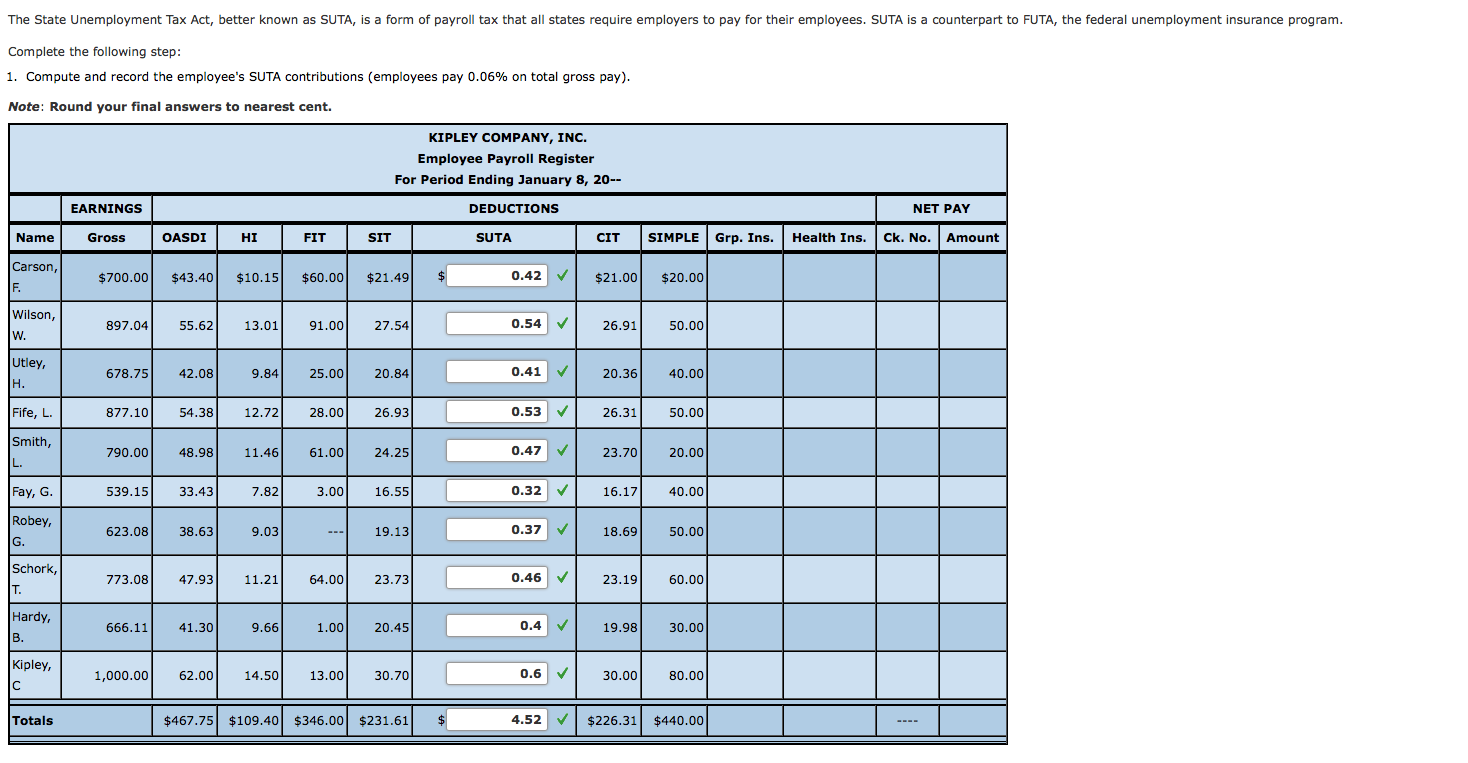

Solved The State Unemployment Tax Act Better Known As Suta Chegg Com

Updating Suta And Ett Rates For California Edd In Qbo Youtube

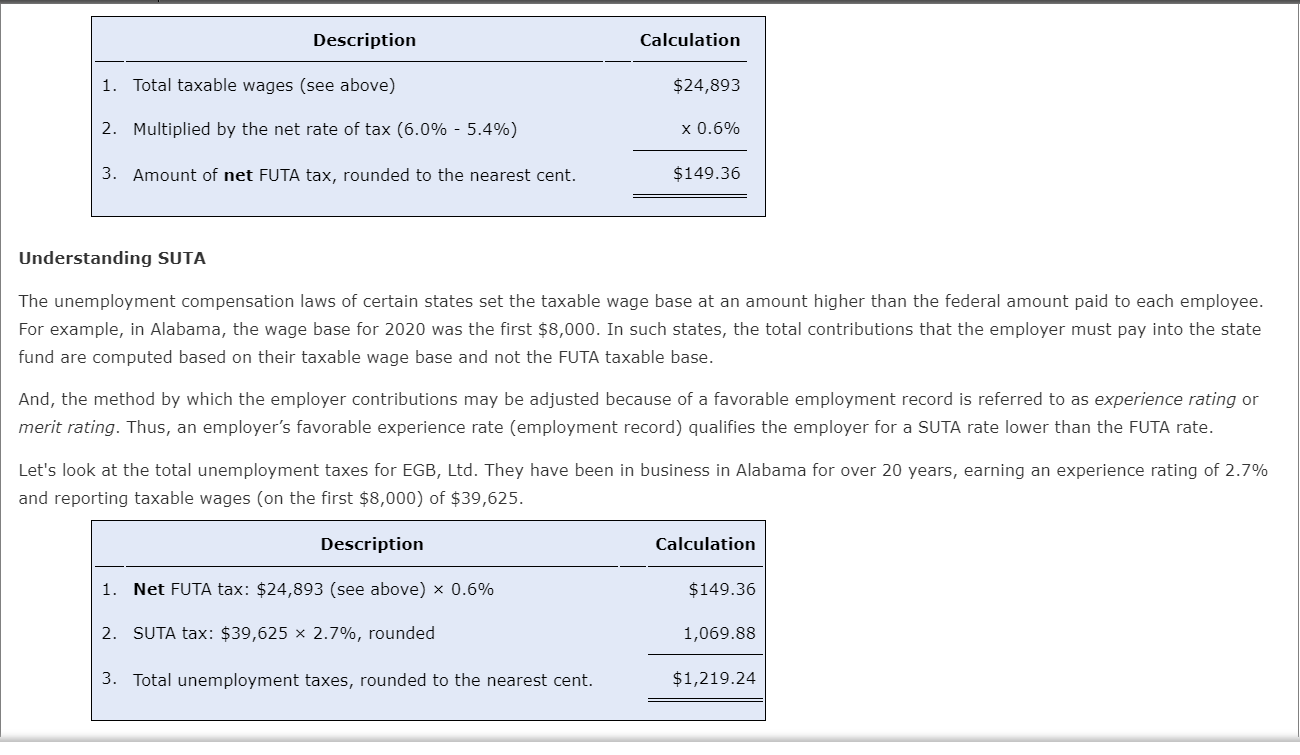

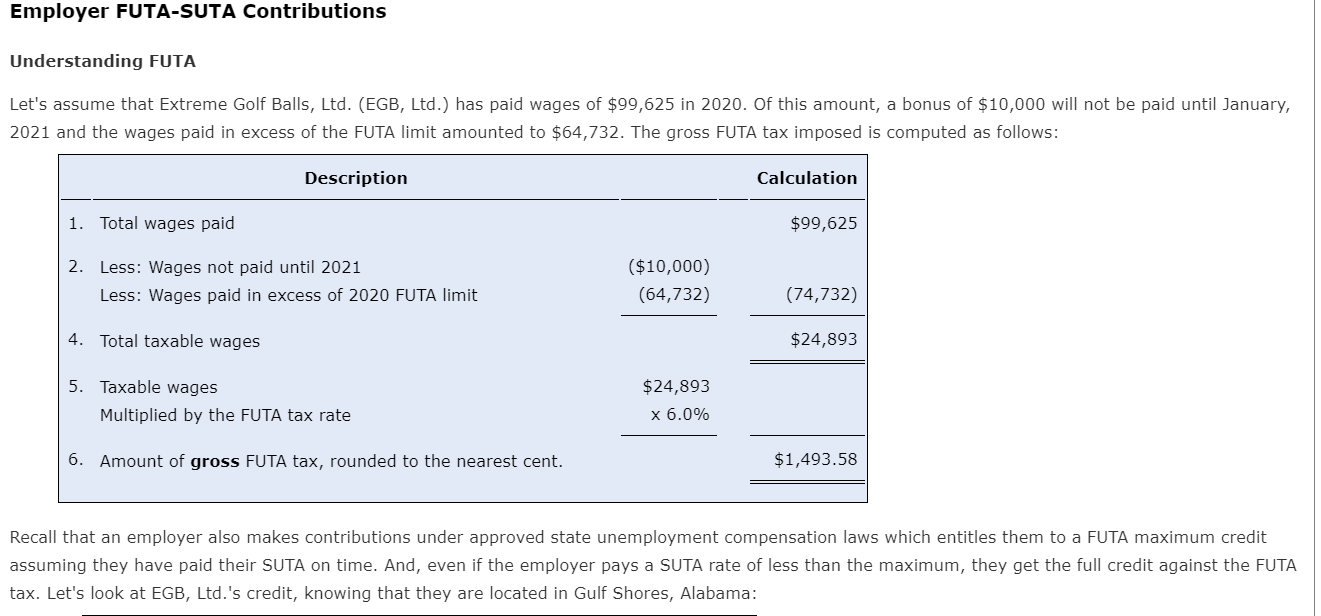

Employer Futa Suta Contributions Understanding Futa Chegg Com

Employer Futa Suta Contributions Understanding Futa Chegg Com

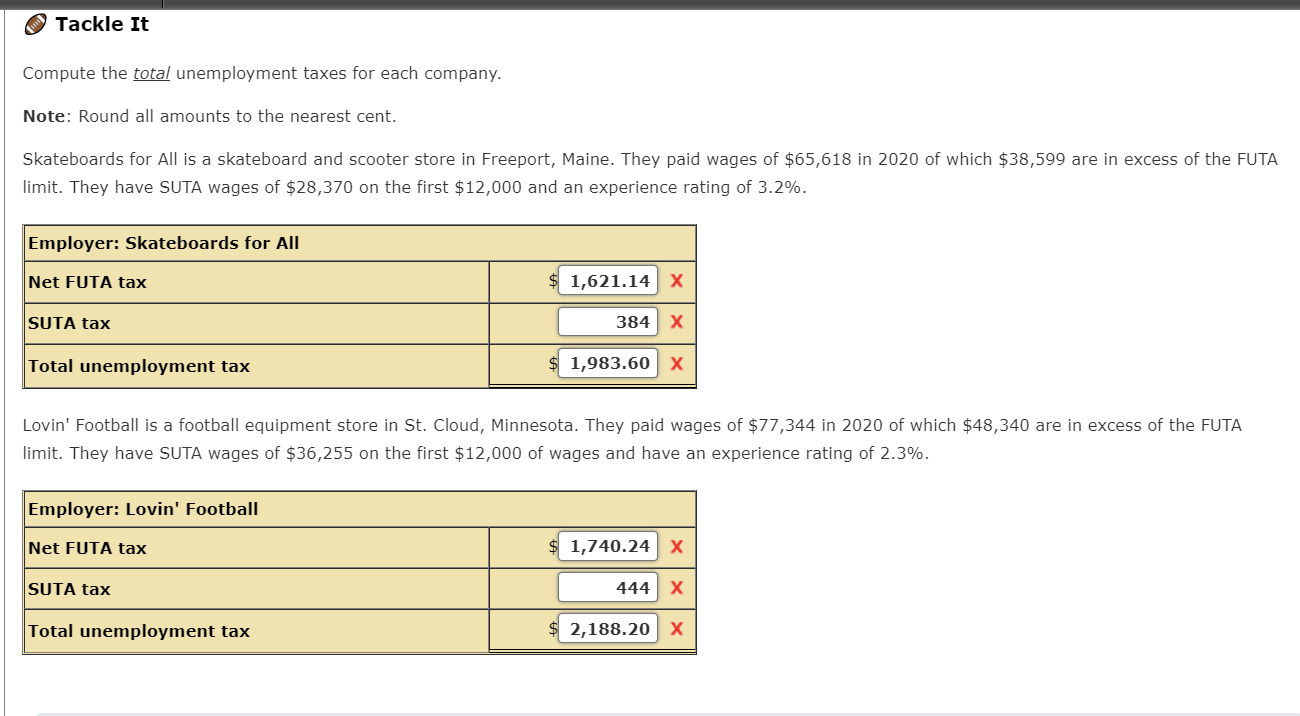

Employer Futa Suta Contributions Understanding Futa Chegg Com

What Is Sui State Unemployment Insurance Tax Ask Gusto

What S The Cost Of Unemployment Insurance To The Employer

Exclusively Blown For Swank Lighting By California Artist Joe Cariati These Violet Beauties Are From The Second Edition Of Jo Lamp Glass Lamp Glass Table Lamp

Ultimate Guide To Sui And State Unemployment Tax Attendancebot

Ezpaycheck Payroll Software Futa And Suta

Suta Tax Your Questions Answered Bench Accounting

How To Update Suta And Ett Rates For California Edd In Quickbooks Desktop Youtube

State Unemployment Tax Act Suta Bamboohr

Futa Tax Overview How It Works How To Calculate

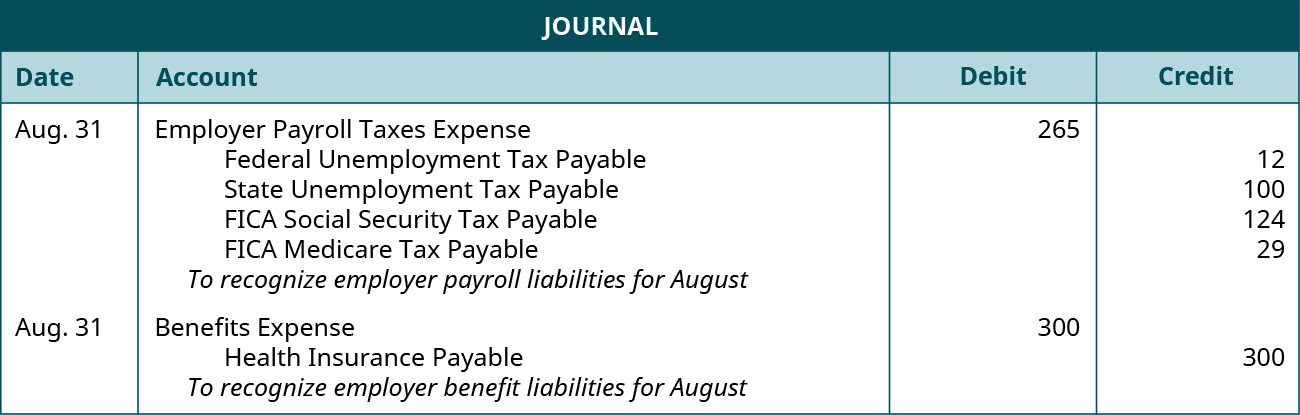

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

Solved The State Unemployment Tax Act Better Known As Suta Chegg Com